We Provide Accounting and Bookkeeping Services: Peace of Mind and Accuracy

We assist small and large business owners in saving time and money on bookkeeping and income taxes by offering dedicated experts and user-friendly financial software. This allows you to concentrate on expanding your business.

Get your month of bookkeeping for $210/month

Served more than 15,000+ clients in the US, and they trusted us

Understanding the Importance of Bookkeeping

Understanding the importance of bookkeeping is essential for any business. It ensures accurate financial records, aids in decision-making, and supports regulatory compliance. By maintaining meticulous records, businesses can assess their financial health, plan effectively, and mitigate risks.

Financial Backbone

Bookkeeping acts as the financial backbone of your business, providing essential support for the effective management of your economic resources. It involves meticulously recording every monetary transaction, from sales to purchases and expenses, ensuring a solid foundation for financial operations.

Assessment and Planning

Assessment and planning are facilitated by this meticulous record-keeping. The treasure trove of financial data allows you to assess your business’s performance accurately and plan future financial strategies with precision. It enables you to identify the most profitable aspects of your business and areas where costs can be reduced to enhance overall efficiency.

Forecasting for Financial Health

Forecasting for financial health becomes more reliable with thorough bookkeeping. By analyzing past transactions and current financial trends, you can better forecast future financial needs. This foresight is crucial for maintaining a healthy cash flow, ensuring your business can thrive and grow even in the most competitive markets.

Importance of Strong Bookkeeping

Strong bookkeeping is essential for robust cash flow management, which is vital for any business operation. Accurate and up-to-date records of all cash inflows and outflows ensure that every financial transaction is accounted for, providing a comprehensive overview of the business’s financial cycles.

Facilitating Informed Decision-Making

By understanding their financial cycles better through strong bookkeeping, business owners can make more informed decisions regarding investment, spending, and savings. This knowledge enables them to manage their resources effectively and optimize their financial strategies.

Predictive Financial Management

Effective cash flow management facilitated by strong bookkeeping allows for the prediction of financial shortages and surpluses. This predictive capability enables businesses to engage in better strategic planning, ensuring financial stability and resilience in the face of uncertainties.

Importance of Effective Bookkeeping

Effective bookkeeping plays a pivotal role in managing your budget effectively. It allows for meticulous comparison of actual spending against budgeted forecasts, enabling swift identification of discrepancies or potential overspends.

Vigilant Financial Oversight

Regular monitoring of financial figures facilitated by effective bookkeeping ensures vigilant financial oversight. This proactive approach helps prevent budgetary excesses and ensures efficient allocation of business resources.

Maximizing Resource Impact

By enabling timely adjustments in spending habits, effective bookkeeping maximizes the impact of every dollar spent. It ensures that business resources are allocated efficiently, enhancing overall financial performance.

What you get with Bookkeeping By CPA

Why settle for ordinary bookkeeping when you can trust a specialized CPA firm for less? Enjoy enhanced accuracy, tailored strategies, and personalized service that align with your business needs, ensuring meticulous financial management and unmatched value.

Operational Efficiency

Our commitment to operational efficiency includes monthly bank and credit card reconciliations, consistent book maintenance, and precise financial statements. We utilize robust software like QuickBooks to ensure accurate and streamlined financial management.

Ease & Accessibility

Our services prioritize ease and accessibility through cloud-based data hosting, eliminating the need for a QuickBooks purchase. We also offer a secure online portal for easy access to your financial information, ensuring convenience and peace of mind.

Support & Representation

We provide robust support and representation with complimentary IRS/State audit representation, proactive IRS/State notice resolutions, and unrestricted year-round consultations. Additionally, we ensure regular face-to-face or phone meetings to keep you informed and supported throughout the year.

Starting Your Bookkeeping Journey: A Simplified 3-Step Process

Kickstart your bookkeeping with ease through our streamlined approach, designed to get your financial management up and running swiftly and efficiently.

- ✔ Easily calculate your personalized monthly fee based on your business's monthly expenses.

- ✔ Fill out our online form, and an SK Financial representative will promptly reach out to tailor our services to your needs.

- ✔ Experience a hassle-free setup as we seamlessly integrate your business into our system, starting your bookkeeping services immediately.

Modern Bookkeeping Software

In the digital age, using software like QuickBooks, Xero, and FreshBooks simplifies bookkeeping for businesses. These platforms automate tasks from invoicing to payroll, saving time, improving accuracy, and offering insights through advanced analytics.

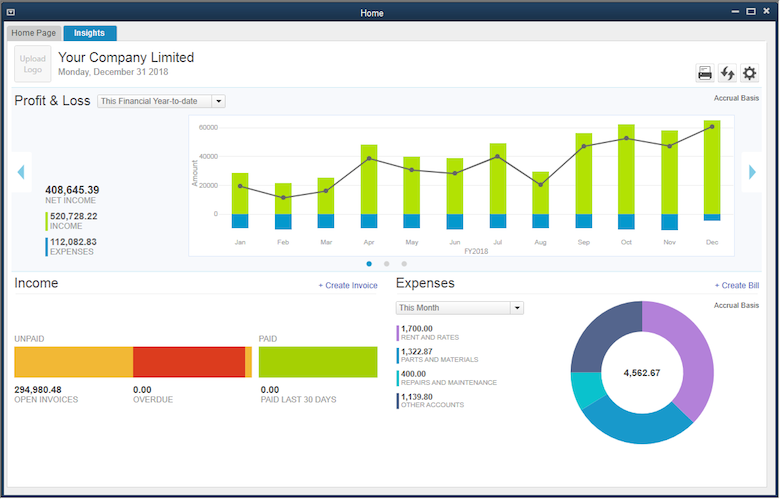

QuickBooks

QuickBooks is a widely-used accounting software known for its user-friendly interface and robust features. It simplifies tasks like invoicing, expense tracking, and financial reporting, making it ideal for small to medium-sized businesses.

QuickBooks

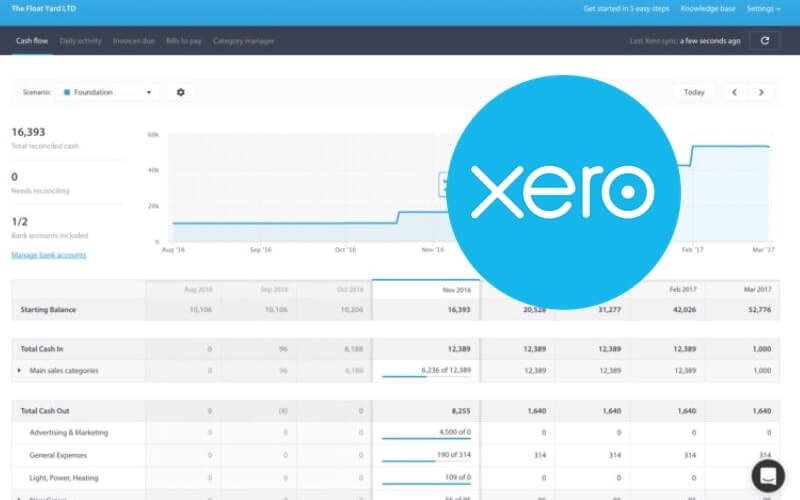

Xero

Xero is another popular cloud-based accounting solution that offers a range of tools for managing finances, invoicing, and inventory. It’s known for its accessibility, scalability, and integration capabilities, making it suitable for businesses of all sizes.

Xero

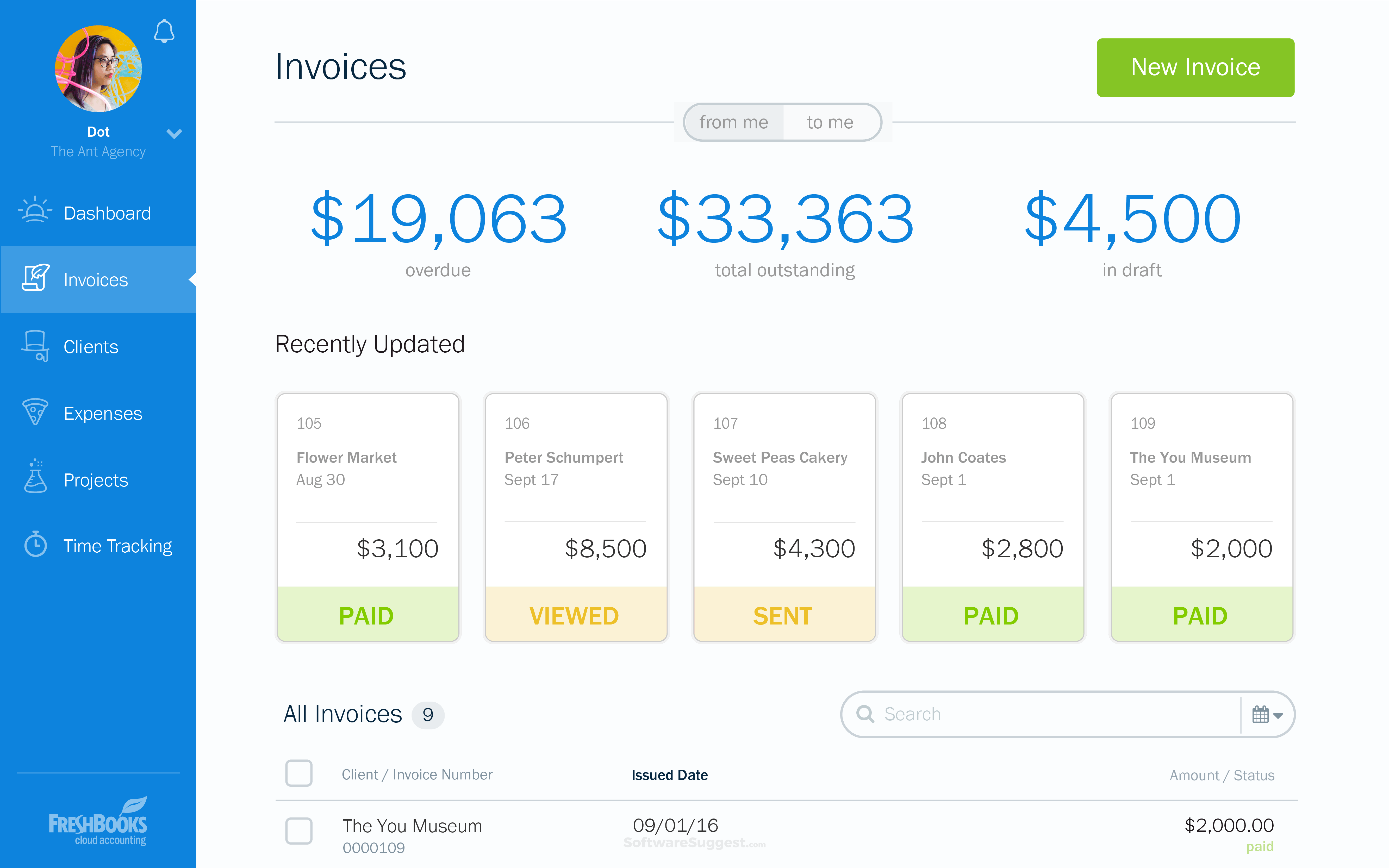

FreshBooks

FreshBooks is a user-friendly accounting software designed for freelancers and small businesses. It specializes in invoicing, time tracking, and expense management, providing simple yet powerful tools to streamline financial tasks.

FreshBooks

Join thousands of business owners who trust us! Behind Bookkeeping by CPA, the SK Financial team works diligently.

Why settle for ordinary bookkeeping firms when you can entrust your finances to a specialized CPA firm for less? Experience enhanced accuracy, insightful strategies, and personalized service that seamlessly align with your business needs, ensuring meticulous financial management with unmatched value.

Our Pricing

Our bookkeeping services are priced to provide you with exceptional value. With clear, upfront fees and no hidden costs, you can manage your budget confidently.

Bookkeeping

- No Setup Fees

- Month to Month

- Fee: Monthly Expenses

- Fee Calculator Available

Bookkeeping involves recording a company’s financial transactions daily. Proper bookkeeping allows businesses to track all information on their books to make key operating, investing, and financing decisions.

There are two main types of bookkeeping systems:

- Single-Entry Bookkeeping System: This system is used for businesses that are not buying or selling on credit. It’s similar to maintaining a personal checkbook. It’s simple and records each transaction once.

- Double-Entry Bookkeeping System: This system records transactions using entries made in two accounts and is necessary for most businesses, particularly those that deal with credit transactions.

The single-entry bookkeeping system best suits small businesses with no inventory, few transactions, and primarily cash-based sales. It is a simple, straightforward approach but needs to provide details on aspects like accounts receivable, accounts payable, or other detailed financial data.

Double-entry bookkeeping provides a more complete, accurate financial picture of a company by recording each transaction in two accounts, maintaining the balance (Assets = Liabilities + Equity). This system helps in error detection and fraud prevention and is essential for creating full financial statements.

Popular bookkeeping software includes QuickBooks, Xero, FreshBooks, and Sage. These tools offer basic and advanced functionalities that can help streamline the bookkeeping process, enhance accuracy, and provide valuable financial insights.

While bookkeeping software significantly aids in maintaining financial records, having an accountant can be beneficial, especially for complex businesses. Accountants can offer strategic advice and tax planning services and help ensure that your financial practices comply with laws and regulations.

Good bookkeepers are detail-oriented, have strong numerical skills, and be proficient with bookkeeping software. They also need a solid understanding of financial principles and business operations, as well as effective communication and organizational skills.

It is best to update your books frequently to reflect your business’s financial status accurately. Many businesses update their records daily, weekly, or monthly, depending on their size and the volume of transactions.